Bid-ask spread and slippage

Bid-ask spread and slippage explained

Crypto markets are famous for their volatility. Due to such high volatility, traders often face high bid-ask spreads and slippage. But what do these terms mean? Let's find out.

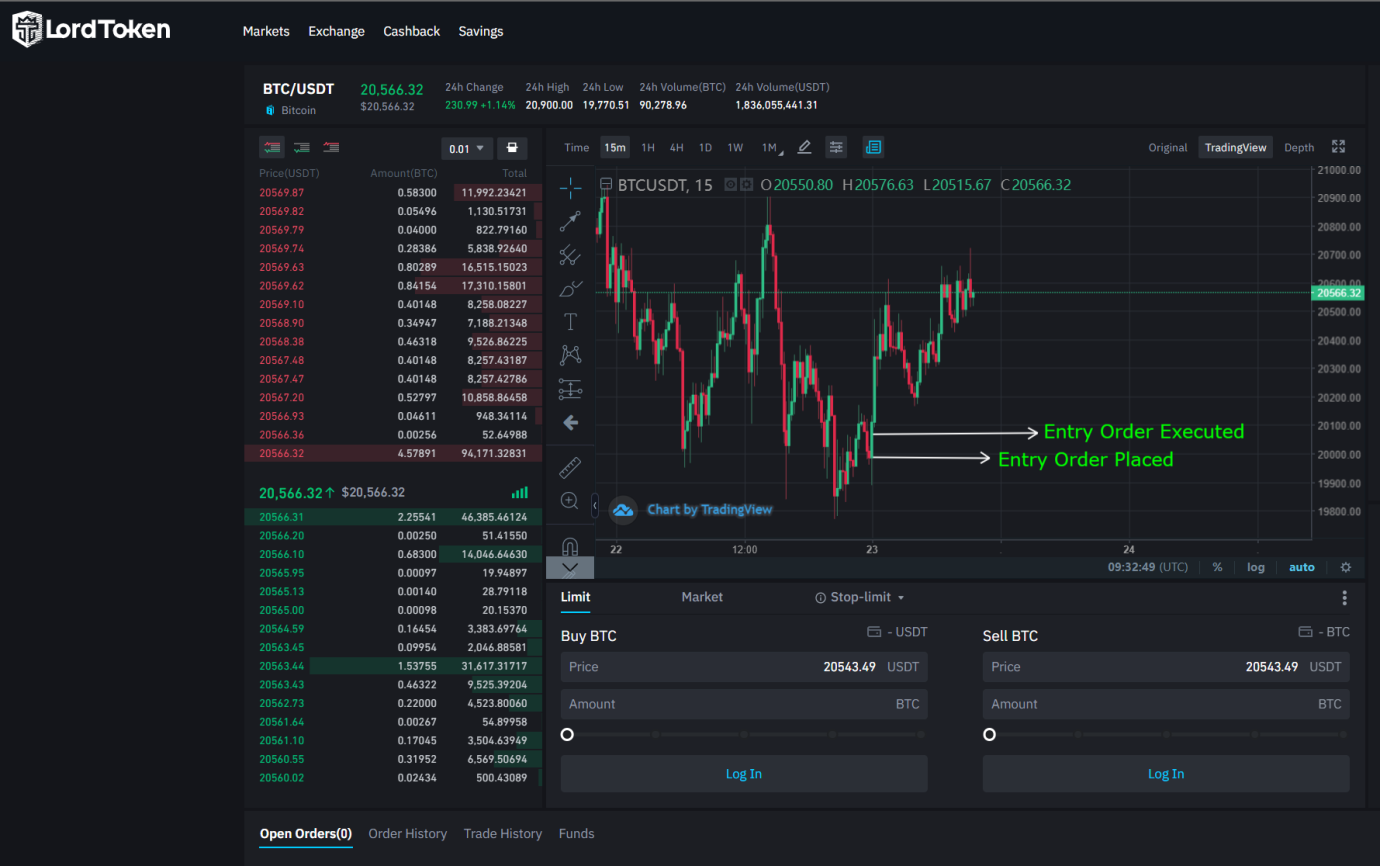

The difference between the highest price a buyer is ready to pay for an asset and the lowest price a seller is willing to accept is known as the Bid-Ask Spread.

These prices are recorded as bids and asks on an order book, posted as limit orders by market makers. Price takers will issue market orders to purchase or sell an asset, accepting the best bid or best ask set by the market maker.

The spread is computed by subtracting the best bid from the best ask on an asset's order book at a given time.

The spread eventually acts as a gauge of an asset's supply and demand.

When the gap widens, it signals that supply and demand for an asset have changed as market makers modify the best bid/best ask they are ready to accept.

Spreads, Market Depth, and Their Relationship to Liquidity

Spread is the most commonly cited indication of a market's liquidity in conventional markets.

Lower spread means the market is highly liquid.

Wide spreads imply that an asset's liquidity is poorer, making it more difficult to exchange the asset at stable prices.

How are spreads and market liquidity related?

This connection results from the interplay of market makers (those who place bids and asks), price takers (those who place market orders to purchase and sell an asset), and the market depth of an order book (the number of bids and asks on an order book at different price levels).

Because of this, market depth and spread have a tight relationship: when there are numerous bids and asks put at deep price levels for an asset, this implies that the order book can absorb more oversized market orders easily with minimum changes to the price of an asset.

As a result, spreads tend to contract as market makers respond to the large volume of orders, making their positions more stable.

When market depth is low, big market orders can more quickly drive an asset's price down (or up) by chewing through an order book, disrupting market makers' positions.

Thus, the spread may represent the risk that market participants perceive, which might rise or decrease depending on the market's depth and liquidity.

Spreads generally expand during price volatility as market makers hedge their holdings to avoid getting stuck in an adverse price movement.

In these cases, the spread represents the market maker's assessment of the risk associated with price volatility.

If spreads stay wide following a period of volatility, it may signal that market makers anticipate continuing price volatility.

What is Slippage?

Slippage is a phrase used in financial trading to describe the difference between a trade's projected price and the actual price at which the trade is completed.

It is a phenomenon that happens when big orders are made during periods of high volatility and when there is inadequate purchasing interest in an asset to sustain the anticipated trade price.

Slippage can occur when a trade order is executed without a corresponding or when a stop loss is imposed at a lower rate than specified in the original transaction.

Slippage happens during periods of, maybe due to market-moving news that makes it unable to execute trade orders at the expected price.

In this instance, forex traders would most likely execute deals at the next best asset price unless a limit order is in place to halt the trade at a specific price.

A change in spread causes slippage during high volatile markets. The spread is the difference between an asset's ask and bid prices.

What impact does slippage have on your trading?

Slippage is inescapable; thus, it must be factored into your trading strategy. Slippage will be included in your overall trading costs, spreads, fees, and commissions.

One method is to examine the slippage you've encountered over a month or more and use the average slippage when calculating your trading expenses.

This will give you a more realistic picture of how much you need to make to break even.

Conclusion

Spreads may disclose a lot about individual market liquidity and the overall liquidity of specific exchanges.

Spread is calculated using order book data and is a necessary data type for traders to consider when deciding which markets to trade in.

By comparing spreads across different exchanges or currency pairings, we can acquire insights into particular market microstructures that are not immediately visible from transaction data.